Largest Asset Managers in The World

Updated on

Published on

Have you ever wondered who watches over all the money people invest worldwide, from retirement accounts to university endowments? A group of powerful firms, known as asset managers, handle these huge sums and decide where to put the funds—like stocks or bonds—to help them grow. In this guide, we’ll explore ten major players as these are the best asset management firms, each managing billions or even trillions of dollars. Whether you’re a seasoned investor or just curious about the giants that steer global finance, these companies impact economies and everyday folks’ savings. Below, you’ll find which firm ranks where, how much money they oversee, and why they stand out in today’s financial world.

Why Work With an Asset Manager?

Some people love to do their own investing. They’ll spend hours each week reading market news, watching trends, or researching companies. Others just don’t have the time or desire to learn every single detail. For those folks, hiring an asset manager can feel like a relief. Here’s why:

- Expertise: Professionals in this field spend their days studying markets and checking possible risks.

- Time Savings: Rather than spend hours figuring out which stock to buy, you can focus on other things in life.

- Diversification: Managers usually spread money across various investments, which helps lower risk if one part of the market does poorly.

- Monitoring: Markets move quickly, and it takes constant watchfulness to see if changes are needed.

In addition to investment management, consulting an asset protection attorney can help safeguard your wealth from legal risks and unforeseen financial threats. When you hire a big firm, you’re tapping into a wide range of knowledge. Of course, every service comes at a cost, so people should always check fees and see if they’re comfortable paying for professional guidance.

The Top 10 Asset Management Firms

Below is a list of the ten largest asset management companies by the amount of money (in trillions of dollars) they look after. We’ll break down each one so you can get a sense of why they’re so huge and what sets them apart.

10. Capital Group: Home of American Funds - $2.6 Trillion

Capital Group, with $2.6 trillion under management, is known for its American Funds family of mutual funds. They keep a quieter profile compared to some rivals, focusing on steady research and active stock picking. Founded in 1931 in Los Angeles, they’ve spent many decades fine-tuning their process, seeking growth that can endure market swings. Financial advisors often recommend American Funds as a balanced approach, blending cost efficiency and thoughtful strategies. That combination of tradition and performance secures Capital Group a spot among the biggest money managers out there.

9. UBS: The Swiss Safe Haven - $2.6 Trillion

UBS, from Switzerland, oversees around $2.6 trillion, offering wealth management and investment services, they are known as one of the best asset management firms. They carry the classic Swiss image of private banking and secure approaches, but they also engage in worldwide finance for institutional and retail clients. Formed by joining several Swiss banks, UBS has offices across continents and invests in many parts of the market. Their private banking arm is especially known for helping wealthy families protect their money over generations. This reputation for caution and depth helps UBS keep a strong position in asset management circles.

8. Goldman Sachs: Wall Street’s Icon - $2.8 Trillion

Goldman Sachs manages about $2.8 trillion for both giant corporate clients and high-net-worth individuals. While they’re famous for investment banking—handling big mergers or stock offerings—they also give advice on long-term portfolios and run mutual funds for everyday investors. Some might think of them as suited for the rich and powerful, but they’ve opened up easier ways for smaller customers to invest too. Their brand stands for high-level strategy and sometimes bigger risks, drawing in clients who want advanced financial ideas. Even with past controversies, they remain a key voice in global markets.

7. Crédit Agricole (and Amundi): A French Force - $2.9 Trillion

Crédit Agricole, along with Amundi, manages about $2.9 trillion, marking them as a top European asset manager. Amundi began expanding by buying smaller investment firms and now helps European savers and institutions find a variety of fund options. The link to Crédit Agricole, originally a rural bank helping French farmers, gives them credibility and broad reach. While not as well-known in the U.S. as some names here, they’re recognized in Europe for offering stable, long-term solutions. This combination of a classic bank and a modern fund manager cements their spot near the top of the field.

6. JPMorgan Chase: Banking and Asset Management United - $3.7 Trillion

JPMorgan Chase manages around $3.7 trillion in assets, ranking it among the largest banks in the U.S., if not the world. The JPMorgan name has that ring to it and almost everyone in the world has hear it before, but it earned that ring... which is why it is one of the best asset management firms in the world. They offer investment management, advice for retirees, plus services for companies and government funds. Formed by merging several historic banks, the firm has a long track record in both lending and stock/bond investing. Part of their clout is the giant research and analyst squads that keep tabs on global markets. This gives clients a sense of stability and expertise when they hand over their savings to be invested.

5. Morgan Stanley: Where Wealth Meets Corporate Deals - $3.6 Trillion

Morgan Stanley manages about $3.6 trillion, juggling both the fast-paced world of investment banking and wealth management for wealthy clients. Since starting in 1935, they’ve helped major companies go public and merged big brands, but they also handle people’s money to grow it steadily over time. Their wide network of advisors, stock researchers, and specialized teams caters to a range of investor needs, from everyday families to corporate treasuries. Because of this mix, they sit among the top asset managers worldwide, even as they compete with other household financial names.

4. State Street: The Masters of SPDRs - 4.3 Trillion

State Street Global Advisors oversees around $4.3 trillion, including a famous brand of exchange-traded funds called SPDR (“spider”). One well-known SPDR fund tracks the S&P 500, letting investors easily buy a small piece of hundreds of large U.S. companies. While they’re part of the broader State Street Corporation—known for custody banking and record-keeping—they stand as a separate asset management arm. Institutions and everyday people use their ETFs for simple and transparent investment solutions. Although they may not be as talked about as BlackRock or Vanguard, their influence on modern investing is huge.

3. Fidelity: The Blend of Active and Index Funds - $5.3 Trillion

Fidelity manages over $5.3 trillion, placing it high among global asset managers. Unlike Vanguard, known mostly for index funds, Fidelity offers both active (expert-run) and passive (index-tracking) funds, suiting investors who want a mix of approaches. Founded by the Johnson family, it remains privately owned, allowing them to focus on long-term improvements instead of quarter-to-quarter results. Their analysts do deep research into companies, seeking opportunities to boost clients’ portfolios. Additionally, Fidelity’s user-friendly website and retirement tools have made them a go-to for many individuals and workplaces.

2. Vanguard: The Champion of Low Fees - $9.3 Trillion

Vanguard handles about $9.3 trillion, propelled by their belief in low-cost index funds that track different parts of the market. Founded by John Bogle, Vanguard is designed so the firm basically belongs to its investors, reducing shareholder pressure to chase high fees. Because of this, they pass cost savings back to clients, giving everyday people affordable ways to invest long-term. Many 401(k) plans rely on Vanguard’s straightforward style, focusing on stable and slow-and-steady market gains. Their success shows that, for many, keeping things simple—and cheap—can be a winning formula.

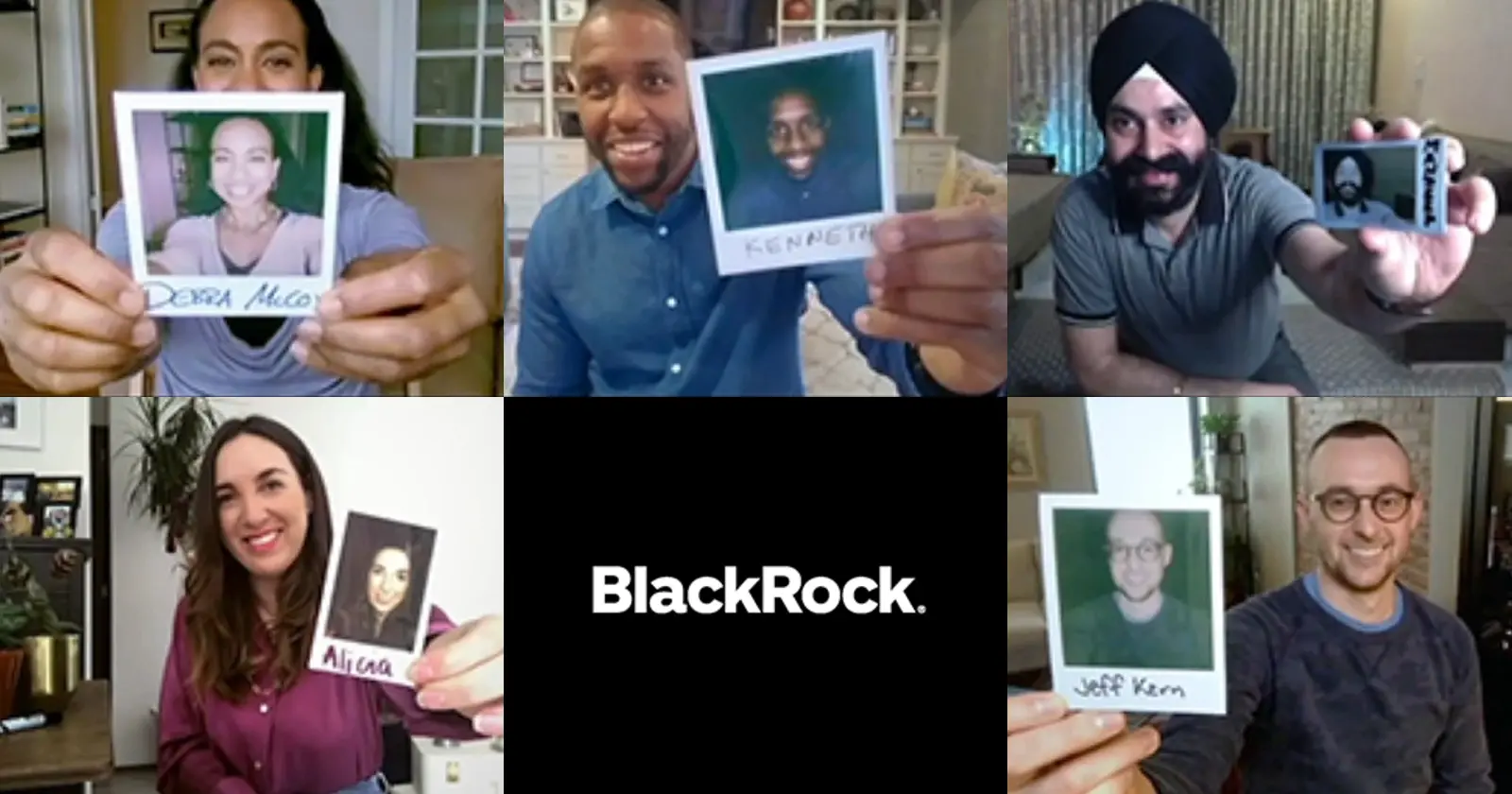

1. BlackRock: The Global Powerhouse - $10 Trillion

Managing over $10 trillion, BlackRock is often crowned the biggest asset manager on the planet. They created iShares, a popular line of ETFs that make it easy and less costly for regular investors to buy bundles of stocks or bonds. A big reason for their success is Aladdin, a robust system that monitors risks and assists in investment decisions. By catering to both large institutions (like pension funds) and individual savers, they’ve built a reputation for versatility and influence. BlackRock’s massive scale means that when they shift money around, it can affect entire markets, making them a true titan in the industry.

Learning from the Big Players

Even if you never plan to open an account with these large managers, you can still pick up a few lessons by checking what they do. For one thing, they often talk about the importance of a balanced plan: not putting all your eggs in one basket. Another useful idea is thinking long-term. Many of these firms encourage clients to leave their money in the market for several years, instead of trying to jump in and out whenever they feel nervous.

These giants also give a sense of how fast the financial world changes. Just a few decades ago, many of them were a fraction of their current size. Technology, global trade, and changing laws have opened new possibilities. Still, the basic task remains the same: use knowledge, experience, and research to help people’s money grow.

Final Thoughts: Where Do You Go From Here?

Deciding who to trust with your money can feel like a big step. But understanding how these major asset management firms work can lighten the pressure. Whether you’re drawn to index fund pioneers like Vanguard or prefer the broad reach of BlackRock, there’s no shortage of options. Make sure you find a match that lines up with your goals, budget, and comfort level.

At the end of the day, the world of finance is about more than numbers on a screen—it’s about the dreams, plans, and security that money can bring. A strong asset manager should not only grow your wealth, but also give you peace of mind in the process. Even if you start small, every step matters. Over time, with careful planning and the right partner, you just might see those funds blossom into something that helps you achieve bigger goals.